19+ Term life insurance

The low cost of term life insurance makes it an excellent fit for families who see the value of financial security but want something they can easily work into their living costs. View the Canstar Direct Life Insurance Star Ratings Methodology and Report.

Insurance Coverage And Covid 19

An employee-paid coverage option that allows you to purchase additional protection as your needs change over time.

. The Direct Life Insurance Star Ratings in the above tables were awarded in May 2022 and data is as at that date updated from time to time to reflect product changes notified to us by product issuers. Term life and permanent life. Assignment of Group Term Life Insurance.

While term life can fit a variety of needs the most common reasons to buy term life are. Oftentimes individuals can convert a current term policy to a permanent life insurance policy if they choose. Often an employer-paid coverage option that is offered for a set period of time and provides your beneficiaries with crucial financial protection.

The amount of coverage you can get depends on which plan you choose. Our Life insurance policies COVID-19 claims subject to applicable terms and conditions of policy contract and extant regulatory framework. Depending on the contract other events such as terminal illness or critical illness can.

Term Life Insurance. We offer term life insurance with term options of 10 15 20 25 and 30 years. This is strictly a term life insurance policy.

Term Life Insurance Plan. But your term policy can change as your needs do. Should I buy term life or whole life insurance.

Buy online term insurance plan in India with tax savings Term insurance premium returned on survival Add-on covers etc. Veterans Mortgage Life Insurance VMLI provides mortgage life insurance protection to disabled Veterans who have been approved for a VA Specially Adapted Housing SAH grant. Insurance premiums are locked-in and never increase during the.

Once that period or term is up it is up to the policy owner. Term life insurance is the most basic and least expensive type of policy you can buy. Learn more about term life insurance.

AAA Lifes Traditional Term life insurance allows you to choose 10- to 30-year terms with coverage ranging from 50000 - 5000000. Medical questions may be required. Sun Life Go Term Life Insurance.

The monthly premium is based on age and the covered amount you elect from 20000 up to 500000. Term life insurance is a policy where you choose the length of coverage such as 10 15 20 or 30. This insurance pays a benefit to the beneficiaryies as a result of death while covered under the policy.

Sun Life Go Simplified Term Life Insurance. The rating shown is only one factor to take into account when. The percentage savings is for a regular pay Max Life Smart Secure Plus Plan A Non Linked Non Participating Individual Pure Risk Premium Life Insurance Plan UIN - 104N118V02 Life Option for 1 cr life cover for a 35 year old non-smoker male for a policy term of 40 years vs a 10 year policy term with the same details.

Tata AIA Life Insurance offers different types of term policy products like Sampoorna Raksha Supreme and InstaProtect Solution. Life insurance shoppers often grapple with a big choice at the start of their decision-making process. Term insurance plans offer your nominee a fixed sum assured amount in exchange for regular premiums.

50000 and up to 100000. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. 100000 and up to 1000000.

1 Premium based on a 100000 20-year Term Life policy for a healthy 18-year-old female paid by automatic monthly deduction from a checking or savings account. Here we present the 2019 period life table for the Social Security area population as used in the 2022 Trustees Report TRFor this table the period life expectancy at a given age is the average remaining number of years expected prior to death for a person at that exact age. Term life insurance is the most affordable type of life insurance policy.

Dependent spouse or domestic partner. To provide a replacement income for spouse and children. 2 Medical exam is required for age 51 and over and who apply for more than.

What kind of life insurance does Lemonade offer. It lasts for a fixed period of time typically 10 to 40 years depending on your policy which is all that most people need. Aditya Birla Sun Life Insurance Company.

Since it can be purchased in large amounts for a relatively small initial premium it is well suited for short-range goals such as coverage to pay off a loan or providing extra protection during the child-raising years. It provides protection for a specified period or term and you can purchase a policy for 10 15 20 25 or 30-year terms. For coverage 1000000 and over apply for YourTerm Life Insurance.

Veterans Affairs Life Insurance VALife will be available starting January 1 2023 and offers guaranteed acceptance whole life coverage of up to 40000 to Veterans. AAA Life Term insurance covers a 10 to 30-year period during which the monthly or annual premium remains the same. Gene ral In formation The Basic Group Term Life Insurance Program is a state-paid benefit provided for managerial supervisory confidential and other specified excluded employees.

Learn why AAA Life is a great choice for Term Life Insurance. Our policy helps protect your loved ones with coverage of. 50000 and up to 25000000.

We have four term life insurance products. When you buy term life insurance the payments remain level every year for the length of the plan that you select. A type of life insurance with a limited coverage period.

For coverage under 1000000 apply for RBC Simplified Term Life Insurance. Why Buying Term Insurance Policy is a Must During COVID-19 Pandemic. A period life table is based on the mortality experience of a population during a relatively short period of time.

Please get a quote to see if you are eligible to buy online. While term insurance. Call one of our friendly representatives for rates 1-866-503-4480.

Aditya Birla Sun Life Insurance came in to existence with the joint venture between Aditya Birla Group and Sun Life Financial Inc. Find an RBC Insurance Store or Advisor Opens in new window Online option may not be available to all customers. A complete range of insurance services is offered by Aditya Birla.

Starting at 1914mo 22000 annually. In exchange for relatively low rates your beneficiaries get a tax-free lump sum of money after you die. The company is known as a pioneer of Unit Linked Life Insurance plans and has over 600 branches spread over 500 cities across the country.

With a Traditional Term Life Insurance policy from AAA Life youll find that obtaining affordable coverage could be easier than you think. Other coverage amounts over 300000 are available up to 1000000. Term life insurance provides death protection for a stated time period or term.

There is no accumulated cash value. SunSpectrum Term Life Insurance. Continuation of Coverage Upon Loss of Eligibility 801.

If youre unsure how long you need a policy you can shop for term life insurance quotes to see which policy length fits your budget. Erie Insurance COVID-19 Information Center. There are two primary types of life insurance.

2

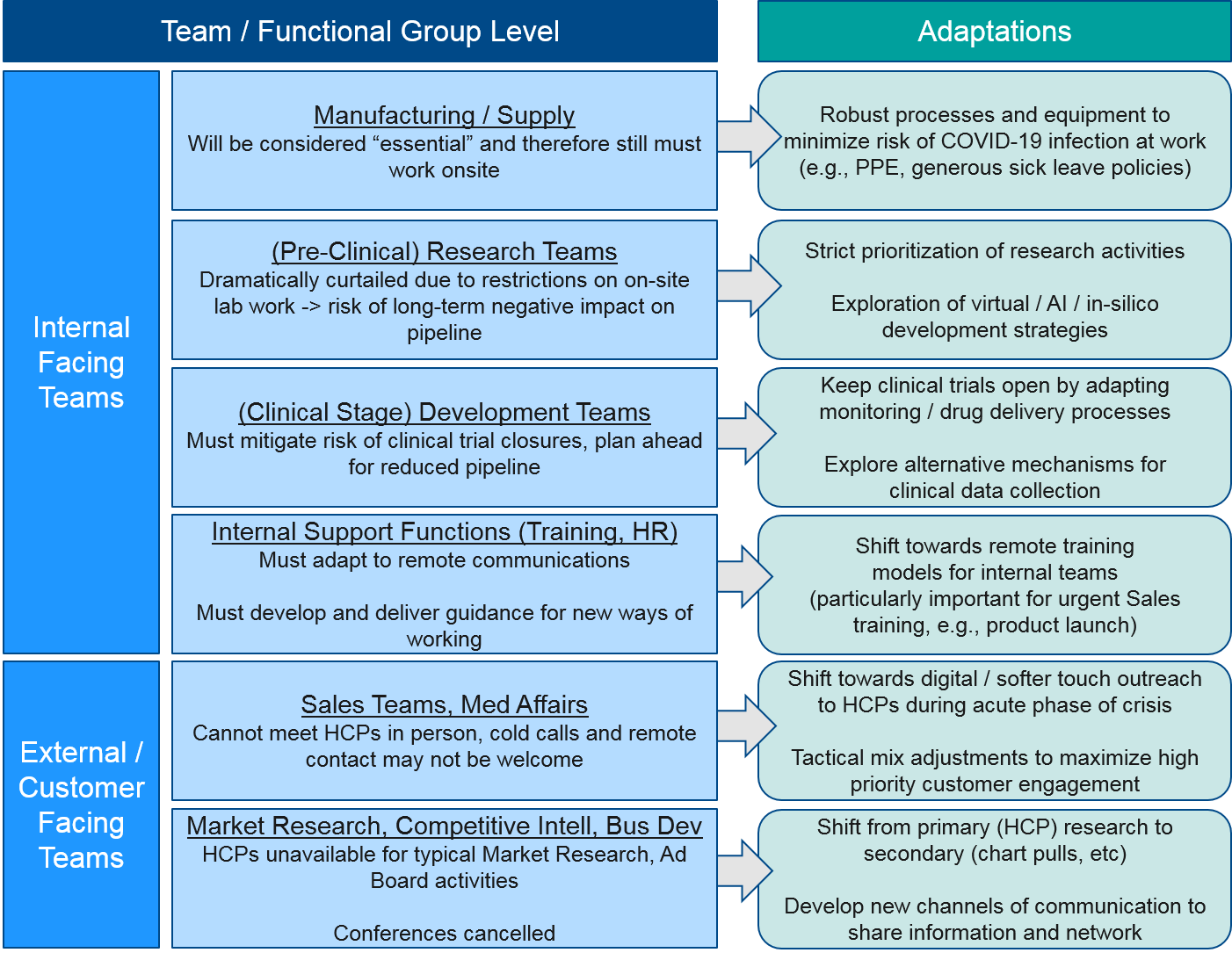

Covid 19 How Pharma Can Adapt Blue Matter Consulting

/xs_and_os-5bfc2b68c9e77c00519a9e75.jpg)

When Should You Get Life Insurance

2

2

When Should You Get Life Insurance

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

2

2

2

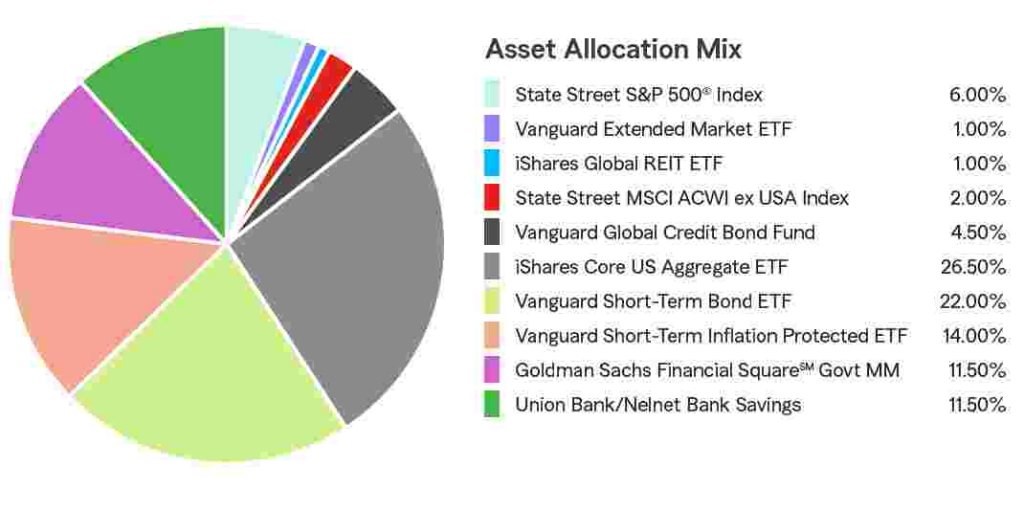

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

2

2

How To Choose 529 Plans For Your Child S Education Moneygeek Com

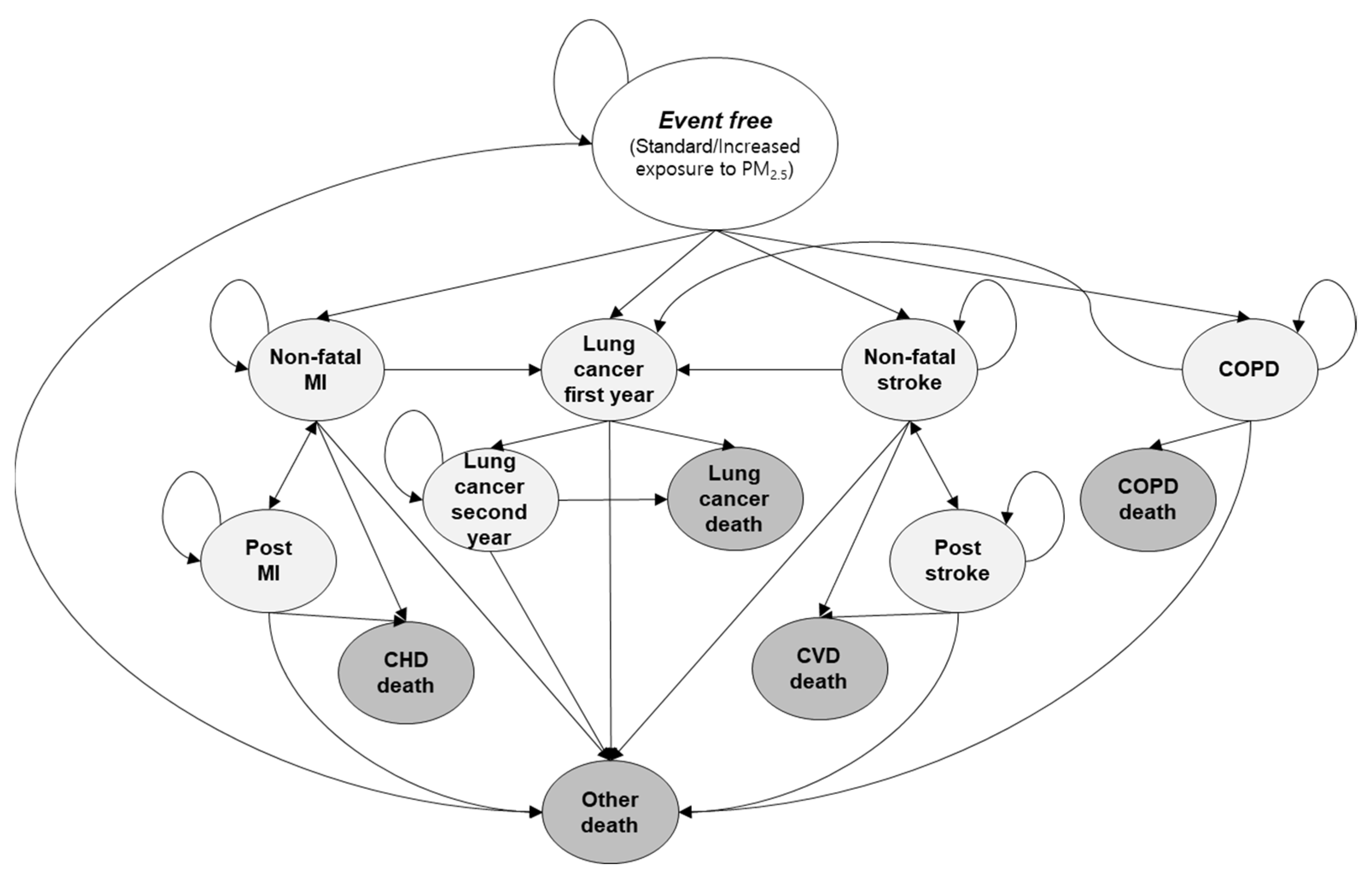

Ijerph Free Full Text Projecting Lifetime Health Outcomes And Costs Associated With The Ambient Fine Particulate Matter Exposure Among Adult Women In Korea Html

Covid 19 How Pharma Can Adapt Blue Matter Consulting